|

|||

|

|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

Best Mortgage Rates in Cleveland, Ohio: A Comprehensive OverviewWhen navigating the often complex world of home financing, understanding the landscape of mortgage rates in Cleveland, Ohio can offer significant advantages. With its vibrant housing market and varied economic dynamics, Cleveland presents unique opportunities and challenges for prospective homeowners. This article delves into the nuances of securing the best mortgage rates in this bustling city, exploring not only current trends but also offering insights into how these rates are determined. Mortgage rates are influenced by a multitude of factors, both at the macroeconomic and local levels. At the national level, economic indicators such as the Federal Reserve's benchmark interest rate, inflation rates, and the overall economic growth play pivotal roles. Locally, Cleveland's real estate market trends, the city's economic health, and employment rates also significantly impact these rates. Potential homeowners should be aware that lenders assess both the broader economic environment and individual financial situations when determining mortgage terms. Currently, Cleveland offers a range of mortgage products, each with its own set of benefits and considerations.

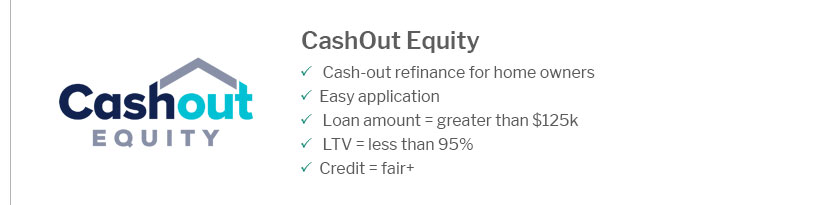

Securing the best mortgage rate in Cleveland requires diligent research and often, negotiation. Shopping around for quotes from multiple lenders can reveal significant variations in offers, allowing borrowers to choose a rate that best suits their financial situation. It's also advisable to work on improving one's credit score, as a higher score generally translates to better loan terms. Additionally, considering the timing of your purchase can be beneficial; economic cycles and real estate market conditions can influence rate fluctuations. Moreover, prospective homeowners should not overlook the importance of local expertise. Consulting with Cleveland-based mortgage brokers can provide personalized insights and access to exclusive local deals that national lenders might not offer. These professionals can guide you through the intricacies of the local market and assist in identifying the most advantageous mortgage solutions. In conclusion, while the journey to finding the best mortgage rates in Cleveland, Ohio, might seem daunting, it is indeed navigable with the right information and resources. By understanding the factors at play and leveraging local expertise, you can secure a mortgage that not only fits your budget but also aligns with your long-term financial goals. Remember, the key lies in informed decision-making and proactive engagement with the market. https://www.key.com/personal/home-loans-lines/mortgage/mortgage-rates.html

Compare current mortgage interest rates and see if you qualify for a .25% interest rate discount. Contact a Mortgage Loan Officer today! https://www.nerdwallet.com/mortgages/mortgage-rates/ohio/cleveland

Today's mortgage rates in Cleveland, OH are 6.825% for a 30-year fixed, 5.988% for a 15-year fixed, and 7.121% for a 5-year adjustable-rate ... https://www.realtor.com/mortgage/rates/Cleveland_OH

Get the latest mortgage rates for purchase or refinance from reputable lenders at realtor.com. Simply enter your home location, property value and loan amount.

|

|---|